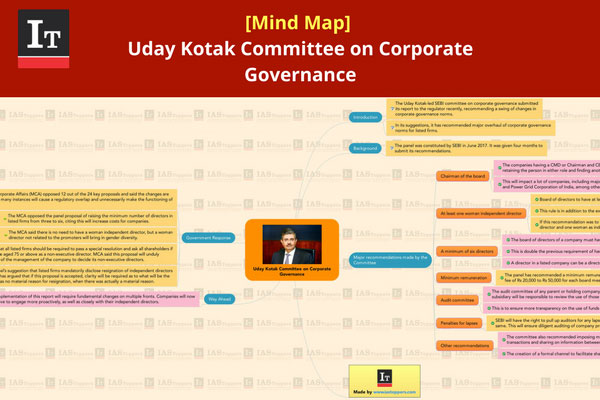

Kotak Committee on Corporate Governance

In News:

Uday Kotak committee established by SEBI has recently released its recommendations addressing rising concerns in corporate governance.

Formation of Committee

- SEBI has set up a committee under the Chairmanship ofUdayKotak, of Kotak Mahindra Bank to advise on issues relating to corporate governance.

- The other members of the committee are the representatives of various stockholding groups, academicians and research professionals.

Terms of Reference of the Committee:The Committee shall make recommendations to SEBI on the following issues with the aim of improving standards of corporate governance of listed companies in India:

- Ensuring independence in spirit of Independent Directors and their active participation in functioning of the company;

- Improving safeguards and disclosures pertaining to Related Party Transactions;

- Issues in accounting and auditing practices by listed companies

- Improving effectiveness of Board Evaluation practices;

- Addressing issues faced by investors on voting and participation in general meetings;

- Disclosure and transparency related issues;

- Any other matter, as the Committee deems fit pertaining to corporate governance in India.

Present scenario

- The existing definition of ‘senior management’ means and includes officers or personnel of the listed entity who are members of its core management team, excluding board of directors.

- Normally this comprises of all the members of the management one level below the executive directors, including all functional heads.

- In India, most companies are run by the dominant shareholder, also known as “promoter” who is either an industrialist or the government.

- Independent directors, who are supposed to represent ordinary shareholders, are chosen not by shareholders but largely by the management, i.e. the promoter.

- At present, the Companies Act, 2013, says that one-third of the directors on board of every public-listed company must be independent directors.

- There’s no way that any independent director would be chosen without the approval of the promoter.

- In public sector enterprises, the appointment of independent directors is at least independent of the CEO because it’s the ministry concerned that appoints independent directors.

Recommendations on corporate governance

- The Committee, while redefining senior management, recommended that the term ‘senior management’ shall specifically include ‘company secretary’.

- The Committee recommended that secretarial audit must be made compulsory for all listed entities.

- It also clarified that the same may be extended to all material unlisted Indian subsidiaries.

- This is in line with the theme of strengthening group oversight and improving compliance at a group level.

- Committee also recommended certificate from a company secretary, providing that none of the directors have been debarred or disqualified from being appointed or continuing as directors by any such statutory authority.

On Independent Directors

- Board – It recommended a minimum of 6 directors and a maximum of 8 to be on the board of listed entities.

- And at least 50% (currently one-third) of the board should have independent directors and compulsorily one woman among them.

- It also called for more transparency on appointment of independent directors and a more enhanced role for them.

- It proposed a mandatory formal induction for every new Independent Director appointed to the board.

- It said that stakeholders should approve the application to fill a casual vacancy of office of any Independent Director.

- It held that no person be appointed as alternate director for an independent director of a listed company.

Other Recommendations

- The panel suggested making a distinction between the roles of chairman and MD/CEO of listed companies.

- It emphasized on regular interaction between NEDs (non-executive director) and the senior management.

- It also suggested an Audit Committee review for the use of loans or investment by holding company for over Rs 100 crore.

- It suggested increasing the number of Audit Committee meetings to five every year.

- It also proposed making D&O (Directors and Officers) insurance mandatory for independent directors, for top 500 companies by market capitalization.

Unaddressed Areas

- In India, there are independent directors who are beholden to the promoter for their place on the board.

- Theydon ‘have considerable freedom to express them, as vast majority of private companies treat promoter and CEO in a same rank.

- So it would be quite a challenge for an independent director to question decisions of a board.

Way Forward

- The recent instances of rift between the founders and the management of companies drew serious attention to the shortfalls in corporate governance.

- These have considerably weakened the confidence in the quality of board supervision and auditing.

- The panel has thus suggested a host of changes for bringing in transparency at companies’ boards.

It is now up to the market regulator, SEBI to move forward on implementing the panel’s recommendations.

Independent Directors

- An Independent director is a non-executive director who does not have any kind of relationship, material or financial, with the company.

- Independent directors are to ensure the independence of decisions taken in matters related with the board.

D&O Insurance

- Directors and officers Insurance is a liability insurance payable to the directors and officers of a company, or to the organization itself.

- It is provided as reimbursement for losses or advancement of defense costs in the event of loss as a result of a legal action brought for alleged wrongful acts in their capacity as directors and officers.

Classic IAS Academy is an age old name in the list of IAS Coaching in Delhi. Just like an ordinary stone becomes a beautiful glittery diamond after proper cutting and polishing, Classic IAS Academy honed my skills to make me a gem in the world of IAS. They made me aware of my own potential which helped me clear the IAS examination in a hassle-free manner. I would like to express my sincere gratitude to the Classic IAS Academy faculty members, who helped me sail through the rough times of preparation for this examination, in a calm and composed way.

Corporate Governance

Leave a Reply

You must be logged in to post a comment.