In News

According to the Global Economic Prospects (GEP) report, the global and Indian economic output will expand in 2021-22.

In-Detail

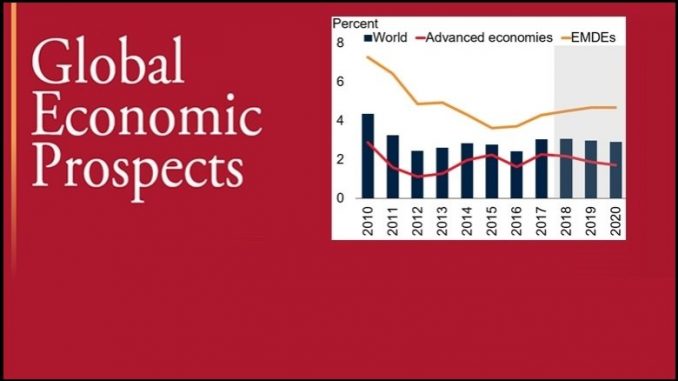

- According to the World Bank’s Global Economic Prospects Report (GEP), the global economic output is projected to grow by 4% in 2021.

- But the projections are 5% below pre-pandemic levels.

- For the fiscal year 2021-22, India is expected to grow at 5.4% and 5.2% for the fiscal year 2022-23.

- For the fiscal year 2020-21, there was an expected contraction of 9.6%.

- The contraction in India is mostly due to a sharp decline in household spending and private investment.

- According to the GEP report, in the informal sector, there was severe income loss which accounts for 4/5ths of employment.

- But there is a momentum of recovery in the manufacturing and service sectors.

- In 2021, the rebound from the low base will be countered by the subdued private investment growth due to financial sector weakness.

- With the resurgence of the coronavirus, the global recovery has been dampened.

- But this is expected to strengthen the trade and consumption supported by the vaccination.

- After the 3.6% contraction in 2020, the GDP of the US is expected to grow at 3.5% and the Euro at 3.6% in 2021.

- In 2021-22, the EMDEs, the Emergency Market, and Developing Economies are expected to grow at an average of 4.6%.

- This reflects the above-average rebound of China which is expected at 7.9% and 5.2% in 2020 and 2021.

- The key elements to strengthen the economic recovery will be the change in the economic environment and the ability to reduce inequality.

- The inequality of downturn is due to the lowest incomes and would take a long term to regain the jobs, vaccines, healthcare in the post-COVID-19 economy.

- The global debt levels increased massively due to the pandemic.

- The EMDE government debt is expected to increase by 17% points of GDP and the service sector’s output contracts over 9%.

- The immediate priorities of policymakers are to balance the risks from the large and increasing debt loads with the risks of slowing the economy.

- In 2020 due to the pandemic, the South Asian region’s economy is expected to contract by 6.7%.

- As per the GEP report, India’s deep recession is due to the non-bank financial corporations.

- In South Asia, growth is expected to be 3.3% in 2021 and 3.8% in 2022.

- As per the report, downside risks predominate the growth and include financial distress caused by tightening, corporate bankruptcies, unexpected low recoveries across sectors, weather, and climate changes.

- Apart from their pandemic, Central Banks in EMDs have deployed asset purchase programs and will help to stabilize financial markets.

Leave a Reply

You must be logged in to post a comment.